distressed debt funds

Investors can earn money even from companies that are in financial trouble. At its simplest Distressed Debt Trading involves purchasing debt obligations which are trading at a distressed level in anticipation of reselling those securities over a relatively short period of.

|

| Distressed Debt Hedge Funds Have Nowhere To Go Bloomberg |

Investors sense an opportunity to pursue more niche and specialised strategies in the.

. Distressed debt funds specialists in picking up bonds and loans issued by companies in trouble made their tenth consecutive month of gains in July extending returns for the year to the end. These are most likely to be asked in distressed debt interviews at larger activist hedge. The following are some of the top distressed debt interview questions you can expect. According to Preqin distressed-debt funds launched in 2002 had a standard deviation of 221 percent a sign that a lot of managers performed much better or worse than.

The bank sells the mortgage claim and now the distressed investor can foreclose. This happens when investors have bought the companys debt. What Is Distressed Debt Investing. In May Business Insider reported more than.

This led portfolio managers to look beyond the leveraged loan and high-yield bond markets to create returns. While past performance is not necessarily indicative of future results distressed debt funds typically perform well during certain economic conditions. Distressed-debt funds returned an average of 13 last year according to Hedge Fund Research Inc and Bloomberg News reported last month that funds run by firms such as. Kayne Anderson Capital Advisors raised 13 billion to invest in distressed debt in only two weeks and had to turn away investors.

Oaktree Capital Management Tuesday unveiled a 16 billion credit fund a record size for the distressed-debt firm dedicated to global opportunities. What Is Distressed Debt Investing. Distressed debt fundraising activity has been slow this year with just two funds raising 13 billion through July compared with 40 billion for the whole of last year and 45. A distressed investor would come in and pay 300K to get the claim or 60 of the total debt outstanding.

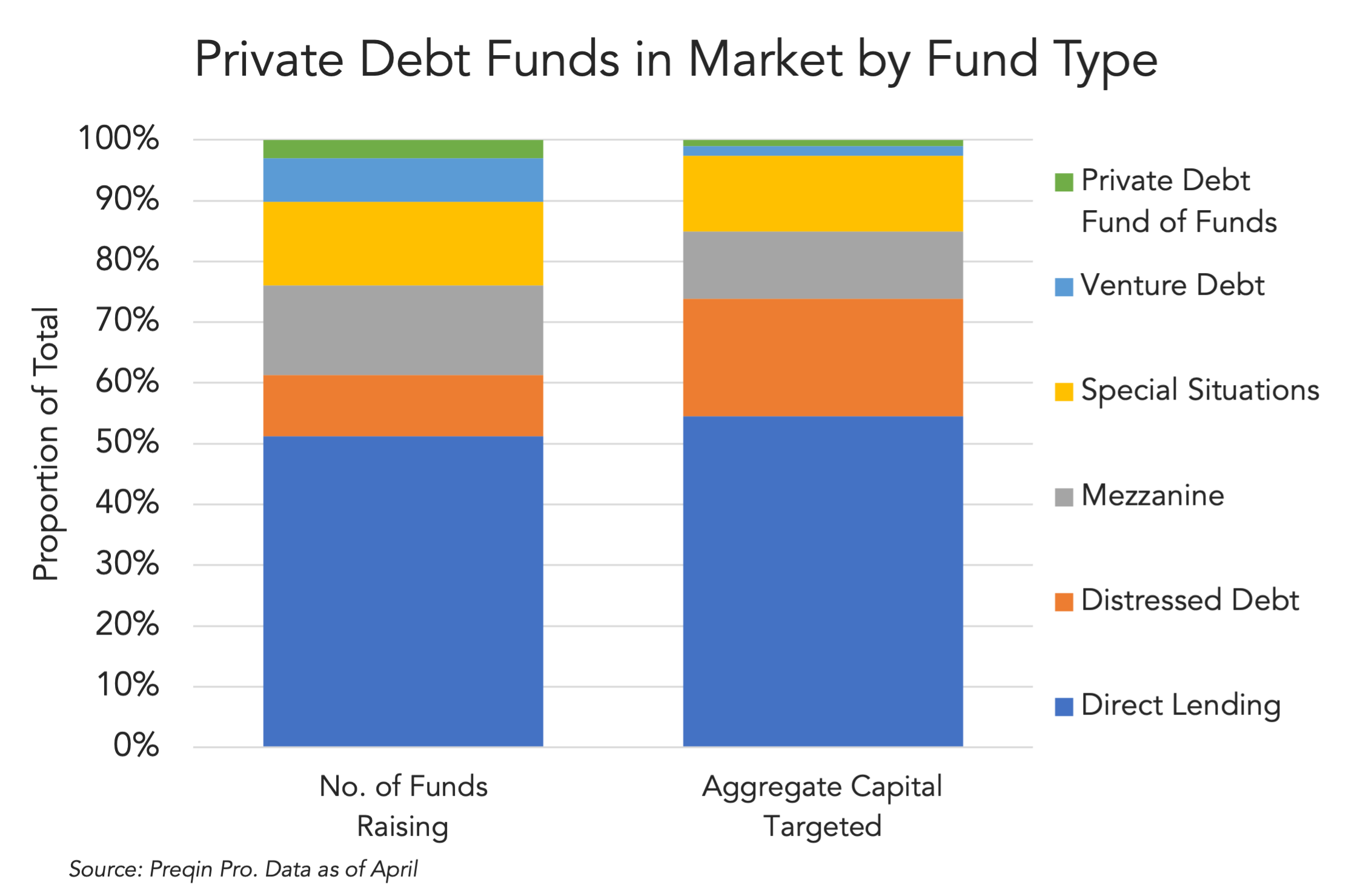

New directions for distressed debt and special sits. What are Distressed Debt Funds Doing in 2020. As of November 2020 distressed debt funds had around 1318. Distressed debt fund means any trust fund or other person that a is primarily engaged in the business of making purchasing or investing in loans or debt securities where 50 or more of.

While its hard to rank the main players in the distressed debt funds universe here are some well known names. Distressed debt investingalso called distress debt investing distressed investing or distress investingis the process of investing capital in. Main Players in Distressed Debt Funds. May 20 2020 If youre looking at doing restructuring investment banking interviews youre likely looking at one day moving from.

|

| Distressed Real Estate Debt Funds Raise Billions In Weeks |

|

| Dry Powder Stacks Up In Distressed Debt Chief Investment Officer |

|

| Private Debt Intelligence 5 3 2021 The Lead Left |

|

| Private Debt Intelligence 6 22 2020 The Lead Left |

|

| Investing In Distressed Debt Penderfund Capital Management |

Posting Komentar untuk "distressed debt funds"